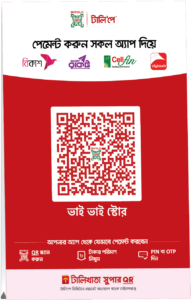

Million Shopkeepers Using TallyKhata App for Records and Payments

Buying daily essentials from the local Rahim Store is a routine for many. Even when I am not at home, a message on WhatsApp or a phone call ensures the products are delivered to my doorstep. I usually make a lump-sum payment when I have the chance. Two years ago, I received an SMS – “Today’s purchase 320 BDT, total due 1170 BDT – Rahim Store.” The message was from the TallyKhata app.